Today, over 70% of Luxembourg residents own their own home. This rate is higher than the European average. Why is home ownership so popular at a time of high property prices? We explain why here.

When moving to a new country, renting your new home is at first sight the most obvious choice. However, if you're planning to expatriate to Luxembourg for two years or more, there are a number of factors that should encourage you to become a homeowner.

Would you like to invest in a rental property? You can also benefit from tax advantages.

Advantageous real estate taxation in Luxembourg

Taxation is one of the main reasons for buying a home in Luxembourg. In fact, taxation on the ownership of a principal residence is quite favorable.

Bëllegen Akt, reduce notary fees on a property purchase

When buying a property, buyers have to pay a fee when signing the deed of purchase at the notary's office. In general, these registration fees amount to 7% of the property price. They are made up of 6% registration fees and 1% transcription fees.

Reduced notary fees on principal residence

However, when buying a primary residence, the new buyer benefits from reduced notary fees. The "Bëllegen Akt" reduces these registration fees for the first purchase of a principal residence in Luxembourg.

Today, the "Bëllegen Akt" establishes a tax credit of 40,000 euros per purchaser of a principal residence for real estate purchases made in 2024. Previously 20,000 euros, then 30,000 euros, this new tax break demonstrates the government's determination to revive the real estate sector, which has been suffering since 2023. A couple can now benefit from a tax break of up to 80,000 euros on notarial fees.

How can I benefit from reduced notary fees on my principal residence?

To benefit from this tax gift, you must personally live in your new home for at least 2 years. If you move out before the required 2 years, you will be obliged to repay the sums granted. On the other hand, you can rent out the property for longer than 2 years, without this tax break being called into question.

Notary fees are also relatively limited for property transfers. See property acquisition costs.

Reduced VAT on housing for primary residences

Principal residences also benefit from a super-reduced VAT rate. In the case of a VEFA purchase of a new home, or of construction or renovation work, the Luxembourg government offers a VAT rate of 3% instead of 17% on the cost of the work.

However, this tax break cannot exceed €50,000 per home as a principal residence. If work is to be carried out on the owner's principal residence, a prior request must be made to the commune where the property is located.

All purchasers of new VEFA homes can also benefit from this reduced VAT rate, provided the home is to be their principal residence.

Lower property tax on a principal residence

Property tax is a tax calculated on built and unbuilt real estate. It is payable annually to the commune where the property is located.

The tax rate is determined by each commune. It applies to the unit value of the property. The unit value is specified to the owner by the Property Valuation Division. To date, the amount of property tax is very low, just a few dozen euros for a house with a garden.

From 2026, a new law will reassess the amount of property tax. Property owners will benefit from a discount on the property tax on their main residence. On the other hand, empty homes and undeveloped land will be taxed more heavily. The aim is to encourage owners to build or rent.

Click here to see the government's property tax calculator.

Capital gains exemption on principal residence

In Luxembourg, the potential capital gain realized on the resale of a principal residence is in principle tax-free. To qualify, the property must :

- have been occupied since acquisition

- or occupied during the 5 years preceding the sale

- or sold for imperative family or professional reasons.

In all cases, the sale must take place no later than December 31 following the year of the move.

If the property sold is unoccupied at the time of sale, the following 3 conditions must be met in order to benefit from the capital gains exemption:

- have occupied the property immediately after acquisition

- and not own another property such as a second home or pied-à-terre

- and the sale must be carried out for compelling professional or family reasons.

Note that a principal residence in Luxembourg may be different from a tax domicile abroad.

In 2024, the sale of a principal residence will be capital gains tax-free if the property is sold to the Housing Fund.

Lower tax rates on rental property

For the sale of an investment property held for more than 2 years, the capital gains tax rate is now 10%, compared with 20% previously.

Deduction of property acquisition costs

The cost of obtaining a property can be deducted from your tax return .To do so, the property must be under construction, renovation or completed. The property may be located in Luxembourg or abroad.

These costs include the cost of opening a mortgage, property tax and interest on the mortgage taken out to purchase the property.

From 2024, the ceiling on tax-deductible interest is 4,000 euros per year per person in the same household. After 6 years, the ceiling is 3,000 euros, and 2,000 euros after 10 years.

Depreciation of a rental investment property

In the case of a VEFA rental purchase, the investor can benefit from a 6% depreciation rate over 6 years, with a ceiling of up to 250,000 euros per year.

Why invest in real estate in Luxembourg?

A real estate market with strong potential for growth

Apart from financial reasons, the Luxembourg real estate market represents a high-potential investment. The fundamentals of the Luxembourg market are solid.

Luxembourg boasts a thriving economy within Europe

By 2022, Luxembourg will have returned to growth levels similar to those seen before the Covid crisis. With a GDP growth forecast of between 3% and 4% for the coming years, Luxembourg's economic development is outstripping the forecasts of its neighbors.

A steadily growing population in Luxembourg

Luxembourg's population is growing steadily. According to forecasts, the resident population will reach 1 million by 2050, compared with 700,000 today.Luxembourg's growing population is generating ever-increasing demand for real estate. The real estate market is under pressure, and homeowners continue to dominate the market.

Housing supply below demand in Luxembourg

In Luxembourg, the number of new buildings is too low. The annual shortfall in additional housing is estimated at 3,000, based on the number of new housing completions (source STATEC). The market remains tight, despite an ever-increasing number of new buildings.

Luxembourg real estate market resilient in a crisis

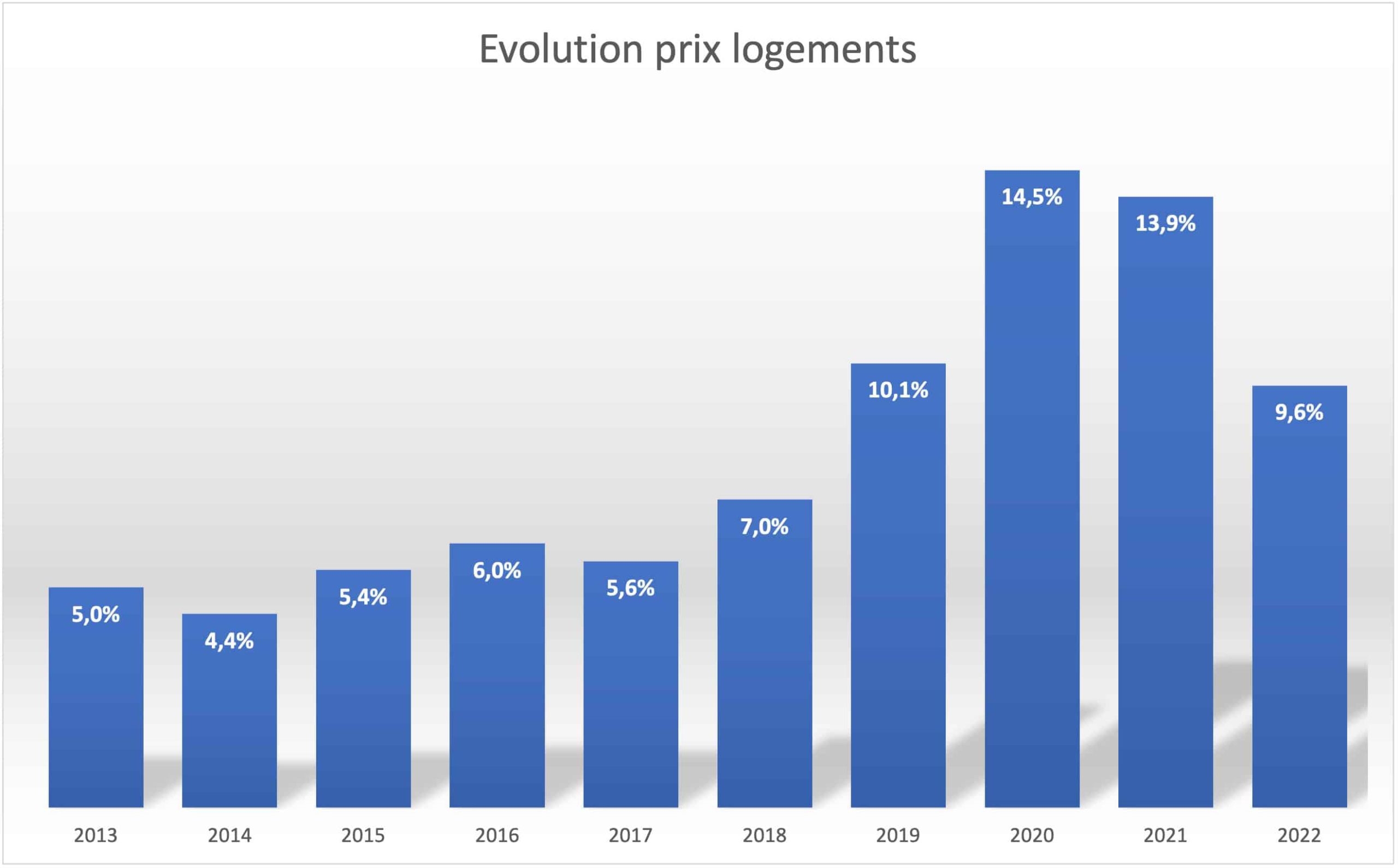

Prices in Luxembourg were little affected by the 2008 financial crisis. Prices only fell by 1% in 2009, then rose continuously by around 5% a year from 2010 onwards. Prices have risen by 10% since 2020.

The property market and rising prices in Luxembourg

Growth in rental prices is now outstripping that of purchases. Rental prices per m² are rising steadily, while purchase prices have been on a downward trend over the past year.

Prices for small surface areas are rising fastest. Investors are strongly attracted by the prospect of returns on real estate.

How to buy a property in Luxembourg

The Luxembourg real estate market is complex.

Considering a property investment requires a good knowledge of local conditions. That's why we advise you to use a real estate agency for your property search. These real estate specialists will be able to explain the market in more detail and provide you with their expertise on the Luxembourg residential market.

What's more, in Luxembourg, agency fees associated with the sale of a property are payable by the vendor. They are limited to 3% of the sale price. So don't hesitate to call in the professionals. They'll be with you every step of the way.

Renting while waiting to buy your primary residence

Where to live in Luxembourg

The only thing that should make you opt to rent before buying your main residence is the need to get to know Luxembourg better. Read our short guide to Luxembourg's towns and cities. Prefer to live in the city? To find out which Luxembourg district to settle in, take a look at our comparison of Luxembourg City districts. It should help you decide which neighborhoods best suit your expectations and lifestyle.

Rental prices in Luxembourg

In Luxembourg, the rental market is very tight. Rents will continue to rise, despite a downturn in the real estate market from 2023 onwards. This is largely due to the surge in rental prices in Luxembourg City, as well as in Esch-sur-Alzette, Luxembourg's second largest city. These two cities alone account for half the supply of rental properties in the Grand Duchy.

However, this rise in rental prices masks a number of disparities. The smaller the surface area of the property, the faster the rise in rental prices. Luxembourg is home to an increasing number of students, trainees and young workers. These people are more inclined to rent studios or small apartments, which contributes to higher prices per m2.

Prices for large apartments and houses have remained stable in recent years, but are still very high. More and more families are moving outside the capital to quiet, leafy communities.

In Luxembourg, real estate agency fees are payable by the tenant and generally amount to one month's rent.

Looking to rent? Find out more about renting in Luxembourg.

Participatory financing in Luxembourg

Luxembourg crowdinvesting platforms

An increasing number of online crowdinvesting platforms are offering participative investments in start-ups or real estate. In this way, entrepreneurs or property developers can bring their investment project to fruition, even if they lack sufficient start-up capital. In return, investors receive a stake in the financed company, but not necessarily a say in its management.

Today, this principle also applies to Luxembourg real estate. Investors can invest in real estate development projects.

This crowdinvesting system is designed for people who are interested in investing in real estate projects. The entry fee is determined according to the project. The average annual profitability of the project must be taken into account at the time of investment.

The Luxembourg real estate market accessible to all

Luxembourg's real estate market offers untapped opportunities that are not accessible to the general public. Reducing investment costs through crowdfunding allows everyone to diversify their investment portfolio .

New participatory housing projects are also regularly launched. The City of Luxembourg has launched 2 participatory housing projects in Bonnevoie for 5 to 6 homes and in Belair for 8 to 9 homes. These participatory housing projects help to reduce costs and enable people to play a more active role in decision-making during the planning, design and construction phases. What's more, from the outset, this system fosters greater solidarity between future residents and more lasting bonds. Could this be one of the keys to "living together"?

Want to invest in real estate? Find out more about housing in Luxembourg