Are you planning to move to Luxembourg? Real estate prices in Luxembourg are structurally high due to a housing shortage. New construction is insufficient to meet growing demand. This is all the more true given that 2023 has largely come to a halt in terms of new real estate projects.

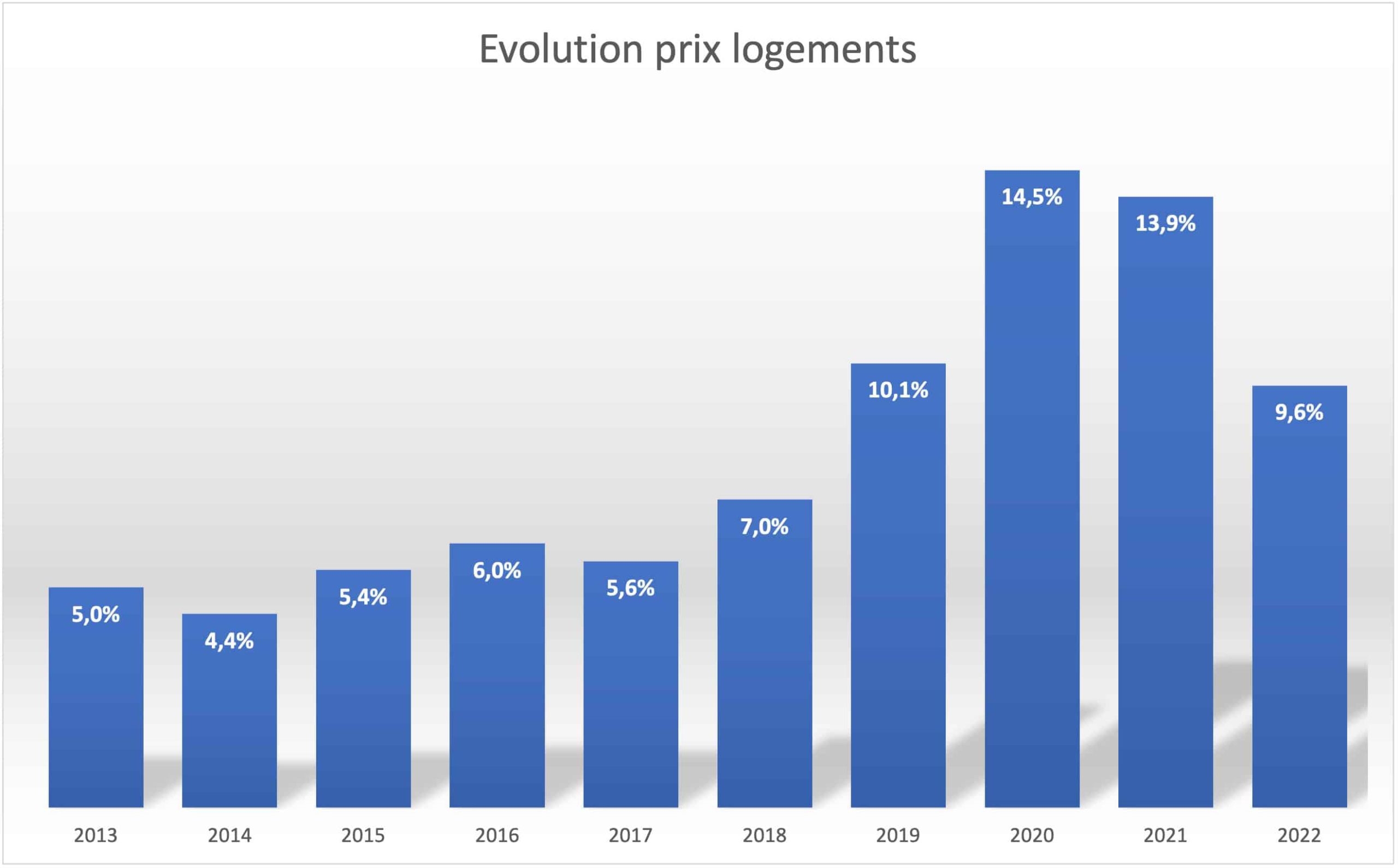

If the year 2022 marked the end of double-digit growth in property prices, the year 2023 showed a fall in purchase prices. It has to be said that rising interest rates on mortgages are not making borrowing any easier. We take a look at what you need to know about housing before buying or renting in Luxembourg.

The latest real estate trends in Luxembourg

Falling purchase prices and a slowdown in 2023

Real estate sales have clearly slowed down in 2023. In concrete terms, mortgage applications have been declining since the end of 2022. The cause: rising interest rates.

In Q3 2023, the number of transactions recorded fell by 32% for existing apartments and 47% for houses. At the same time, sales of apartments under construction collapsed by 60% compared to Q3 2022, and by 56% for building land.

According to STATEC, prices were down by almost 18% for houses and 12% for existing apartments compared with Q3 2023. At that point, developers had not yet passed on the slowdown in demand to their prices, with only a -7% drop.

Continued rise in rental prices in 2023

On the other hand, rents will continue to rise in 2023. Apartment and house rentals will rise by 4% in Q3 2023.

What can we learn from the Luxembourg real estate market?

Falling sales prices, rising rents

Luxembourg continues to attract not only a working population looking for work, but also a high-end clientele. They are looking for a privileged and secure living environment.

However, the housing shortage remains a major challenge for the country.

The average price of an old apartment was around €5,000/m² at the end of 2017. By July 2022, this had risen to €9,208/m². In March 2023 (source Immotop), national prices averaged €8,876/m², with €11,240/m² for the Centre region.

New-build prices continue to hover around 15,000 euros/m2. In Luxembourg, parking lots can fetch up to €130,000, or even more than €200,000/m² in certain areas of the city center.

Rentals are now set at a national average monthly price of €24.25/m².

Location, a key factor in Luxembourg prices

There are, of course, disparities in property prices across the Grand Duchy. The Canton of Luxembourg is undoubtedly the most expensive. The average budget for buying a house is over 1,000,000 euros, twice as much as in the north of the country. Prices become more affordable the further you move away from Luxembourg City.

Prices per m² in the canton of Luxembourg average €9,203/m² new and €8,495/m² old. This compares with prices in the north of the country of €5,227/m² new and €4,424/m² old. Between the 2, prices fall between the Capellen/Mersch region, the East region and the Esch-sur-Alzette region.

For houses, the average price is €1,207,225 in the canton of Luxembourg, €848,777 in Capellen / Mersch and €563,470 in the north, less than half the price of the capital.

Prices vary according to the type of home you're looking for

The surface area and type of housing are determining factors for prices. Overall, prices per m² decrease with the size of the property. It's true that small surface areas play into the hands of investors, who push up the market.

An apartment under construction is 15 to 20% more expensive than an older apartment of equivalent size in the same location. However, in 2022, investors are starting to lose interest in new-build properties in favor of older ones. Yields are more attractive and property availability times are shorter. With Covid, building sites are experiencing delays that are difficult to resolve due to a shortage of raw materials.

Land prices have clearly contributed to the rise in new home prices. This increase is all the more significant in urban areas. On average, house prices rose by 5.7% between 2010 and 2019, while building land prices increased by 7.0% annually over the same period.

What's the outlook for real estate in Luxembourg?

The new Frieden government elected in October 2023 has defined housing as a priority for the country.

Today, local authorities are keen to increase the proportion of apartment buildings or two-family homes as opposed to single-family homes. Only 15 of the more than 100 municipalities have a majority of their housing stock in apartments. These include the top three, with Luxembourg City 80% apartments, Esch-sur-Alzette 69.4% and Hespérange 63.1%.

In concrete terms, the stock of single-family homes, largely represented by 82.8% of residential buildings in 2019, is declining. Apartment buildings account for a growing share of all housing under construction. They now account for over 16% of the housing stock since 2001, compared with less than 7% before 1919.

But when we're talking about a population of over 1 million by 2060, what are the prospects for the future? To prepare the country for these new residents, we could consider reducing the size of housing units to increase the number on offer. Legislation could also evolve to allow higher occupancy rates, for example, by renting out unoccupied rooms.

But today, it's mainly a question of enticing owners to free up land, when they have no interest in seeing prices fall. According to a recent study by the Observatoire de l'Habitat, 84% of potentially buildable land is owned by around fifty private individuals and companies. The next finance laws should be drafted along these lines.

Real estate retrospective of recent years

Luxembourg prices to slow in 2022

After years of overheating, 2022 marks a slowdown in real estate prices, with a year-on-year increase of just 5.6%, a far cry from the double-digit price rises seen in previous years.

Real estate transactions down in number and volume

Sales of new apartments fell by almost half in 2022, while the number of transactions in existing apartments fell by almost 18%. Financial volumes fell by 50.1% for new apartments and by 18.7% for existing properties.

Rising rental prices on the Luxembourg market

The end of 2022 is already marking a rise in rental prices. Rental leases signed over the last quarter show a year-on-year increase of 8% for apartments and +6.9% for houses. Less than 13% of rental ads are for houses, and this proportion is tending to shrink further. The market is still very tight, which means that we can expect to see higher rents in the future?

Property prices to rise by more than 10% in 2020 and 2021

The confinement of 2020 and the spread of telecommuting have once again marked the rise in property prices. These years will see the 2019 rise confirmed with housing price rises of 14.5% in 2020 and 13.9% in 2021 respectively .

New construction is on the increase, not only in Luxembourg City but throughout the country. New projects are springing up all the time (see real estate market). But these projects are not enough to stem the rise in prices.

Individuals are looking for exteriors, made indispensable during confinement, and investing in their interiors. At the end of 2021, the average price of a house in Luxembourg will be €1,371,000.

The capital, Luxembourg-City, remains very popular, and prices are skyrocketing even in the surrounding areas. The north of the country is increasingly in demand, thanks in particular to the Nordstrooss (freeway to the north). Prices are still affordable. The south continues to attract, thanks to lower prices and good connections to the capital. A high-speed tramway will link Luxembourg's Cloche d' Or district to Esch-sur-Alzette, via Foetz, in less than a quarter of an hour by 2030.

Price rises in the real estate industry are progressing faster in Luxembourg than in other European countries, demonstrating the growing interest of customers in this destination.

Luxembourg real estate prices to soar for the first time in 2019

The housing figures published in Q4 2019 by L'Observatoire de l'Habitat and Statec confirm the global feeling. Property prices have soared over the past 12 months. Housing prices have risen by 11% over 1 year, from Q4 2018 to Q4 2019!

This increase is global and more or less homogeneous between the different types of property for sale. House prices are up +9%, new apartments +12.4%, old apartments +12.1%. At the end of 2019, prices stood at €6,057/m2 for existing apartments, €7,145/m2 for apartments under construction.

As for single-family homes, it now costs an average of €789,474 to acquire a property in 2019, an increase of €40,000 in just 2 quarters.

As a result of Brexit and the arrival of foreign workers on the Luxembourg market, the existing imbalance between housing supply and demand has increased. Despite the many projects currently underway, the future supply of new housing is not keeping pace with population growth.

Luxembourg's sought-after districts such as Limpertsberg, Belair, Kirchberg, Grund and Merl continue to offer excellent value for money. Prices in these areas remain in line with expectations. In the rest of the country, development is accelerating in the south. In the west, the community of Steinfort is regaining its appeal thanks to investment in infrastructure projects. The north of the country is finding new interest thanks to the development of road transport networks. Prices remain more affordable. The communes of Ettelbruck, Diekirch and Wiltz are the most dynamic today.

Free public transport means that real estate located close to the network increases in value.

2018: Luxembourg's real estate boom continues

In 2018, the market saw a record 7% rise in prices compared to the previous year. According to experts specializing in residential real estate, over the last 10 years, this increase was more in the order of 5%.

Price rises are most obvious in the older apartment market. In this sector, the increase is close to 10%! New apartments, on the other hand, rose by "only" 6% in 2018 compared with the previous period. House prices have also risen, but less significantly. This price growth is widespread across the country, particularly in the south, where prices are rising rapidly.

Luxembourg's attractiveness in terms of population inflows seems to be the main explanation for this price rise. In 2018, more than 11,000 people moved to Luxembourg, representing 1.8% of its total population. The steady increase in residents is no longer in line with the supply of new housing. In 2018, more than 6,000 additional apartments would have been needed to meet demand. Yet the supply of new units was barely 2,600. What's more, the very low bank interest rates offered on loans are supporting demand for property acquisitions. This is helping to push prices up to record levels.

Rental prices also rose significantly in 2018. This increase was particularly noticeable in the Bonnevoie, Gasperich, Merl and Belair districts. There was a 6-8% rise in the Gare district alone.

2017: the start of the Luxembourg real estate boom

Whether old or new, property prices in Luxembourg jumped in 2017 by 4.10% for houses and 4.70% for apartments. These figures peaked at 6.10% for properties under construction. At this point, a new apartment is valued on average 25% to 30% more than an old apartment of the same surface area. The average price of an apartment was €420,000, compared with €690,000 for a villa.

The joint report by L'Observatoire de l'Habitat and Statec (Institut National de la Statistique et des Etudes Economiques) was unequivocal at the time. The Grand Duchy appeared to be a safe bet, highly prized by investors. The high quality of its real estate and its attractive tax system make Luxembourg an attractive place to invest. In 2017, the volume of transactions rose by +12% throughout the country.

Find out more about accommodation in Luxembourg.

Source: Observatoire de l'Habitat - Liser

Photo credit: Liser