Are you thinking of buying a property in Luxembourg? Are you hesitating between buying new or old? With our real estate specialists, we take a look at the advantages of either purchase.

Advantages and disadvantages of new-build property

Buying a new-build property in Luxembourg offers significant advantages on several levels: benefiting from the latest technological innovations, moving into a new-build property that meets all your design requirements, etc. But that's not all... We tell you more here.

The latest real estate standards and energy optimization

Buying a new property means above all benefiting from the latest building standards. In Luxembourg, these are designed to optimize energy consumption, and therefore to benefit in concrete terms from subsequent energy savings.

AAA passive houses in Luxembourg

Since January 1, 2017, all new buildings in Luxembourg have had to meet passive house construction standards. They must meet AAA energy efficiency classes. This triple A corresponds to optimum energy efficiency, thermal insulation and environmental impact. Energy consumption must be virtually zero (NZEB = Nearly Zero Energy Building).

Energy savings in new housing

In line with passive house standards, AAA constructions guarantee lower energy consumption. They also distribute the heat produced more efficiently. Houses and apartments equipped with the latest energy-efficient technology guarantee very low energy consumption. In the long term, this means lower energy bills for occupants, which is highly appreciable in a context of soaring energy prices.

By comparison, an older property will undoubtedly require additional capital expenditure to improve its energy performance. This is particularly true of homes built before the oil crises of the 1970s.

The energy passport is mandatory for all home purchases. It will enable you to assess the costs involved. Don't forget to ask for one as soon as you visit the property you're interested in!

Buying off-plan in Luxembourg: creating a tailor-made home

Buying new means buying off-plan in most cases. This means that from the outset, you'll be able to project yourself into your future home and participate in its realization.

Exposure of rooms to make the most of light and sunshine, layout of rooms, choice of materials, choice of sanitaryware, kitchen design, etc. Excluding multi-family housing, buying a new home allows you to create a tailor-made home. If you choose to build your own home, you'll be able to meet all your family's needs.

Ten-year warranty for new-build properties

In Luxembourg, whether you buy a new or recently built property, you are covered by a ten-year warranty. This 10-year warranty, provided by the builder, offers the property owner security in the event of construction defects.

In multi-family buildings, the ten-year warranty covers any major condominium work carried out within 10 years of the purchase of the property.

So if you're buying a recent property, be sure to ask whether the ten-year warranty is still in force, even for a single-family home.

Reduced VAT rate for new-build or renovation projects

For the purchase of a new principal residence, the purchaser benefits from a VAT rate of 3% on the cost of construction, provided that he or she occupies the property as a principal residence. This benefit amounts to 50,000 euros per newly-created home. The VAT rate will be 17% for investors wishing to purchase a new property for rental purposes.

Reduced registration fees for new purchases

Registration fees are the fees paid to the notary when a property is purchased. These fees are calculated on the cost of the land and the existing building. They are therefore particularly low if the land has not yet been built on. They will be higher for an existing dwelling.

Beware of delays and prices in new-build property

Since the Covid health crisis and international crises such as the war in Ukraine, lead times for making goods available have tended to lengthen. Whether in apartment blocks or single-family homes, the supply of raw materials is suffering.

As a result, it can take longer to get the keys to your new home. At the same time, raw material prices are soaring. This also affects the final cost of new builds. After new-build property, investors are now increasingly turning to old-build property.

Old real estate: advantages and disadvantages

Older properties have other advantages over new ones.

Immediate availability of older homes in Luxembourg

In Luxembourg, buying an older property can be a very quick process. Once the compromis has been signed, the sale can be completed within 1 to 2 months.

Additional delays are often linked to obtaining a loan, and are therefore the buyer's responsibility. To avoid this, make sure right from the start of your search that you have thebanks' approval for the projected budget of your property purchase. You'll also save yourself a considerable amount of stress when it comes to signing an offer to purchase.

Lower prices per m² for existing properties in Luxembourg

In Luxembourg, the price of older properties is historically 20% lower than the price of equivalent new properties.

See the latest trends in real estate prices in Luxembourg.

The value of old real estate over time

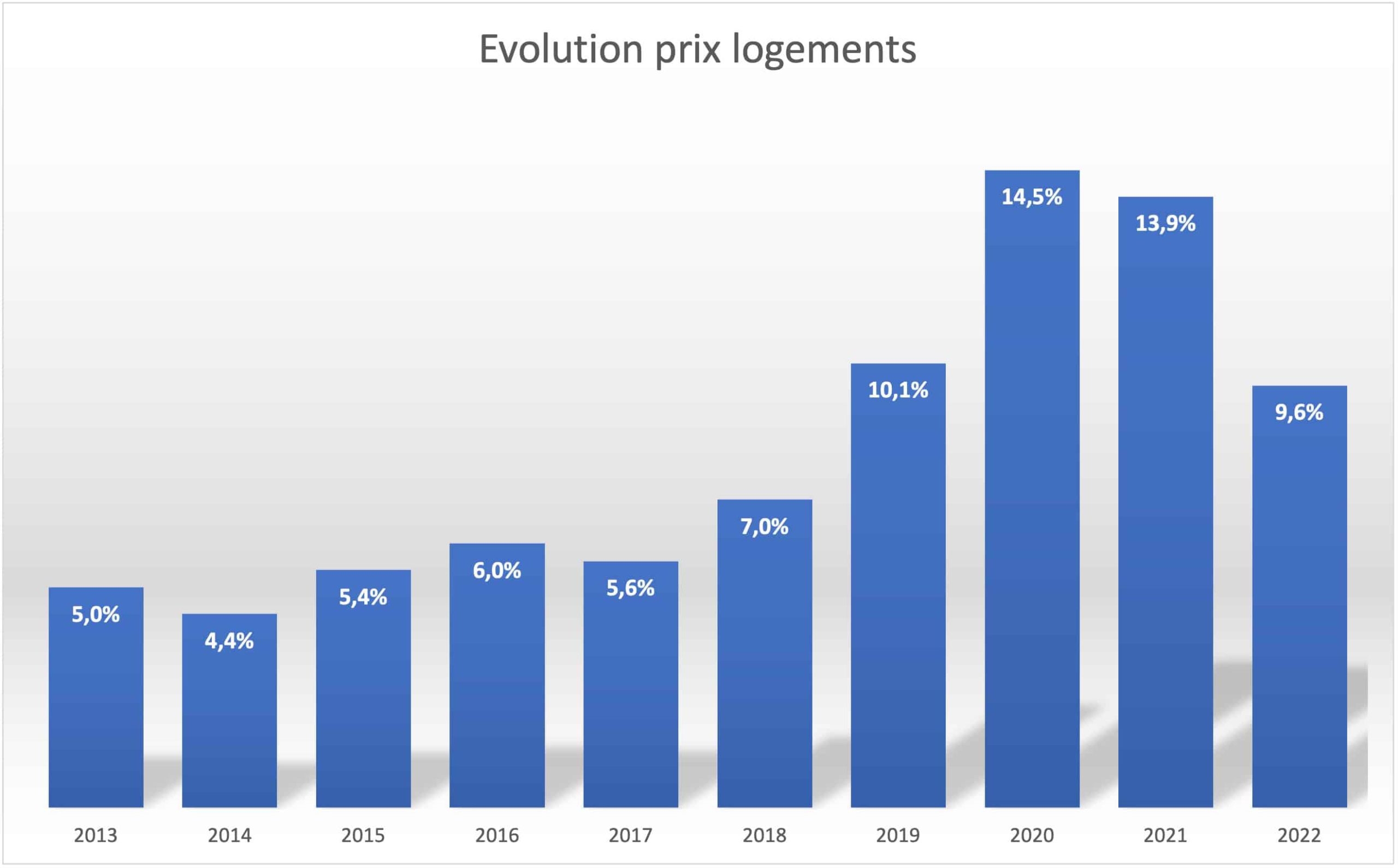

Investing in older property allows you to increase the value of your property over time. With a lower cost per m² and rising property prices, the value of older buildings is likely to increase more rapidly.

This is especially true if the property is located in a sought-after area and/or if you have undertaken renovation work. The market is increasingly demanding in terms of property quality.

People who bought their property more than 15 years ago in Luxembourg have seen their investment double since then.

Larger lots for older homes

Older homes often benefit from several acres of land with large gardens. Built at a time when land prices were still low, older homes have an undeniable advantage in terms of land surface area.

Today, we often see houses from the 50s and 80s demolished to make way for new homes. What's more, with the explosion in demand, local authorities are granting more and more building permits for two-family homes, or even apartment blocks, where previously there were only single-family homes.

This phenomenon tends to reduce average lot sizes for new homes.

Privileged locations with nearby amenities

With few exceptions, older properties are located in highly sought-after areas close to amenities. Closer to city centers, older properties often offer better connections to shops, schools and public transport networks.

New construction is more out of the way, except to say that new neighborhoods are appearing at the same time as new construction, with all amenities nearby. See the real estate market to find out about these new neighborhoods.

In Luxembourg, popular older neighborhoods include Centre, Grund, Belair, Merl and Limpertsberg. More specifically, Gasperich, Kirchberg and Cessange are seeing the emergence of new neighborhoods. See neighborhoods to live in in Luxembourg.

Renovation work and reduced VAT rate

If you are carrying out work on your main residence, including as a tenant, you can benefit from a

If you live in an older home, you can carry out work on it. If it's your main residence, you can also benefit from the reduced VAT rate of 3% instead of 17% on the cost of the work, on application to the administration. See housing subsidies in Luxembourg.

However, the total amount of this benefit may not exceed 50,000 euros per home. You'll need to apply to your local authority to benefit from this advantageous housing VAT. If you're a tenant, remember to ask your landlord for permission before carrying out any work.

Looking to buy a home? Contact the intermediaries who can help you find the right property.